Recent headlines have sent shockwaves through the Canadian economy—former U.S. President Donald Trump has announced a 25% tariff on imports from Canada, effective immediately. This bold move is expected to affect various industries, including real estate, construction, and the broader economy. But how exactly will this impact Canadian homeowners, buyers, and investors? Let’s break it...

Real Estate

The Bank of Canada has officially cut its policy interest rate to 3.0%, a significant move that will impact mortgage rates, real estate inventory, and market trends heading into 2025. Whether you’re looking to buy, sell, or invest, here’s what you need to know: Key Market Updates:Mortgage Rates: As 5-year bond yields adjust, both variable and fixed rates are expected to shift, creating potential...

Understanding the Recent Interest Rate Cut in Canada and Its Impact on Real Estate Market The Bank of Canada recently announced a 50-basis-point rate cut, marking its Final Cut for 2024. This decision, part of an effort to stimulate the economy is setting the stage for a changing real estate landscape in 2025. For Buyers:Lower interest rates bring relief to potential homebuyers, as borrowing costs...

The Bank of Canada has cut interest rates today 4.5%, and this decision has several implications for the real estate market: Lower Borrowing Costs- Cheaper Mortgages: Lower interest rates mean lower mortgage rates, making it cheaper for buyers to finance home purchases. This can increase home affordability and stimulate demand. Increased Buyer Activity- Boost in Demand: With cheaper borrowing costs,...

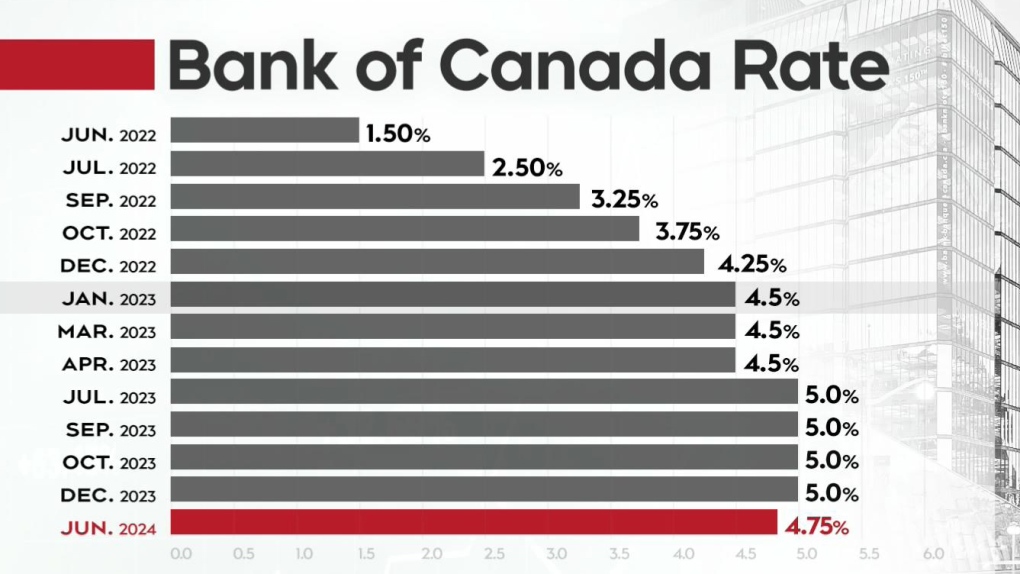

The Bank of Canada recently announced interest rate cut on Wednesday June 5th, 2024, a decision that has wide-ranging implications for the country's economy, particularly the real estate market. This move comes in response to ongoing economic challenges and aims to stimulate growth by making borrowing more affordable. Here, we break down what this rate cut means for Canadians, especially those involved in...