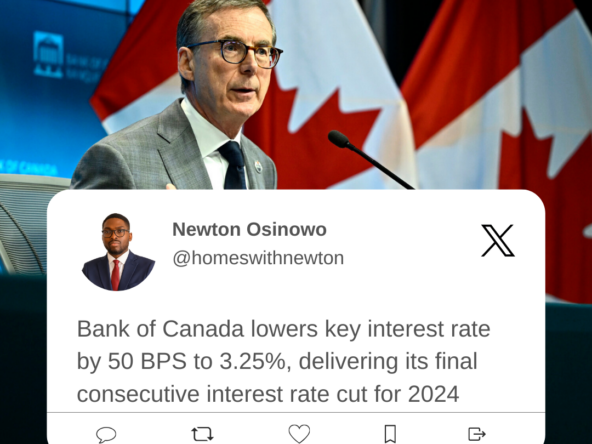

The Bank of Canada has officially cut its policy interest rate to 3.0%, a significant move that will impact mortgage rates, real estate inventory, and market trends heading into 2025. Whether you’re looking to buy, sell, or invest, here’s what you need to know:

Key Market Updates:

Mortgage Rates: As 5-year bond yields adjust, both variable and fixed rates are expected to shift, creating potential savings for buyers and investors.

Toronto Condo Inventory: Supply is increasing—listings have jumped from 3,611 (Jan 2024) to 4,640 (Jan 2025)—offering more choices for buyers.

Condo Prices: While downtown prices are inching back toward $1,000 per sq. ft., the citywide average has declined to $819.02 as of January 2025, following last year’s market peak.

What Does This Mean for You?

Buyers: Lower rates + increased inventory = a prime opportunity to secure a home before demand picks up again. If you’ve been waiting for the right time, this could be it!

Sellers: While a rate cut can attract more buyers, strategic pricing and effective marketing will be essential in a competitive market. Now is the time to position your property effectively.

Investors: Lower borrowing costs and stabilized pricing in key areas present strong investment opportunities. If you’re considering expanding your portfolio, this rate drop could work in your favour.

Let’s Discuss Your Real Estate Goals!

This interest rate cut could be the perfect time to make a move in the market. Whether you’re buying, selling, or investing, I’d love to help you navigate the opportunities ahead.

Let’s connect to discuss how this affects your real estate plans!