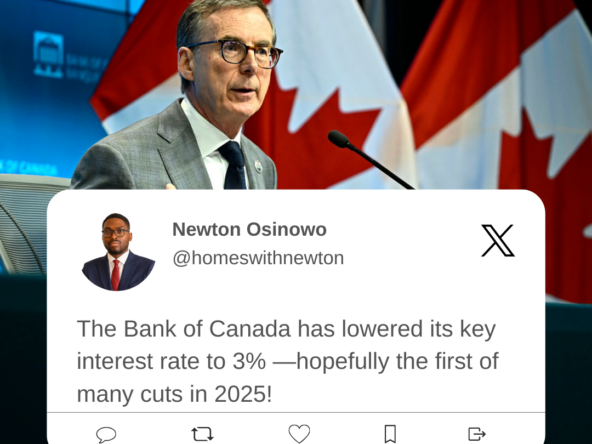

Understanding the Recent Interest Rate Cut in Canada and Its Impact on Real Estate Market

The Bank of Canada recently announced a 50-basis-point rate cut, marking its Final Cut for 2024. This decision, part of an effort to stimulate the economy is setting the stage for a changing real estate landscape in 2025.

For Buyers:

Lower interest rates bring relief to potential homebuyers, as borrowing costs are expected to decrease further into 2025. This means mortgages may become more affordable, which could boost buying power, especially for first-time buyers. However, the pace of market recovery remains slow, and affordability challenges persist due to elevated home prices compared to pre-pandemic levels. Buyers should act strategically, leveraging these rate cuts to secure favorable mortgage terms as the market stabilizes.

For Sellers:

Sellers can anticipate increased activity in the housing market as more buyers re-enter. While home prices are projected to rise modestly, the renewed demand could result in faster sales cycles. Sellers considering listing their homes in 2025 may benefit from the gradual improvement in market dynamics driven by the lower rates.

Despite these opportunities, it’s essential to remain cautious. While the interest rate cuts create optimism, the broader economic backdrop and lingering affordability issues mean the recovery will be steady rather than swift