The Bank of Canada recently announced interest rate cut on Wednesday June 5th, 2024, a decision that has wide-ranging implications for the country’s economy, particularly the real estate market. This move comes in response to ongoing economic challenges and aims to stimulate growth by making borrowing more affordable. Here, we break down what this rate cut means for Canadians, especially those involved in the real estate sector.

The Decision to Cut Interest Rates

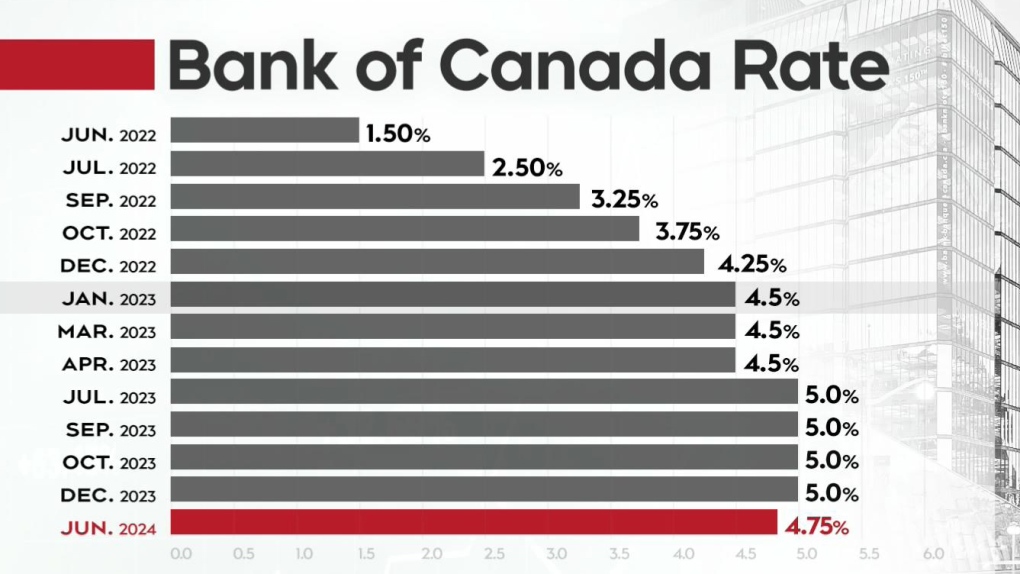

The Bank of Canada decided to reduce the benchmark interest rate by 0.25%, bringing it down to 4.75%. This decision was influenced by several factors, including slower economic growth, lower inflation rates, and uncertainties in the global market. By cutting interest rates, the central bank aims to lower the cost of borrowing, encourage spending, and stimulate economic activity.

How Does an Interest Rate Cut Affect Borrowing?

Interest rates are a critical factor in determining the cost of borrowing money. When rates are low, loans for homes, cars, and businesses become cheaper. For the average Canadian, this means lower monthly payments on mortgages, lines of credit, and other loans. As borrowing becomes more affordable, consumer spending tends to increase, which can help drive economic growth.

Impact on the Real Estate Market

- Increased Buying Power: Lower interest rates mean lower mortgage rates, which translates to reduced monthly payments for homebuyers. This increase in affordability can boost demand for homes, as more people can qualify for mortgages and existing homeowners may consider upgrading to more expensive properties.

- Refinancing Opportunities: Homeowners with existing mortgages may take advantage of the lower rates by refinancing their loans. This can reduce their monthly payments or allow them to pay off their mortgage faster, freeing up cash for other investments or spending.

- Investor Activity: Real estate investors often respond to lower interest rates by increasing their property acquisitions. Cheaper borrowing costs can improve the return on investment, making real estate an attractive option compared to other asset classes.

- Home Prices: Increased demand for homes, driven by more affordable mortgages, can put upward pressure on home prices. While this benefits sellers and homeowners looking to build equity, it can also make it challenging for first-time buyers to enter the market.

Potential Risks and Considerations

While lower interest rates generally benefit the real estate market, there are potential risks and considerations to keep in mind:

Overheating Market: If demand significantly outpaces supply, it can lead to an overheated market where prices rise too quickly. This scenario can create affordability issues and lead to a market correction in the future.

Debt Levels: Lower interest rates can encourage more borrowing, potentially leading to higher household debt levels. It’s essential for borrowers to assess their financial situation carefully and avoid taking on more debt than they can manage.

Economic Uncertainty: Interest rate cuts are often a response to economic challenges. While they can stimulate growth, they also indicate underlying economic issues that could impact the real estate market in other ways, such as job security and income stability.

The recent interest rate cut by the Bank of Canada presents both opportunities and challenges for the real estate market. Lower borrowing costs can drive demand, increase buying power, and stimulate investment in properties. However, it’s crucial to navigate these changes with a clear understanding of the potential risks involved. For anyone considering buying, selling, or investing in real estate, staying informed and consulting with financial and real estate professionals can help make the most of the current market conditions.

As the market evolves, keeping an eye on further announcements from the Bank of Canada and other economic indicators will be key to making informed decisions. Whether you’re a homebuyer, homeowner, or investor, understanding the implications of interest rate changes is essential in navigating the ever-changing real estate landscape in Canada.